Advancements in Payment Gateway Technology and their Implications for E-Commerce

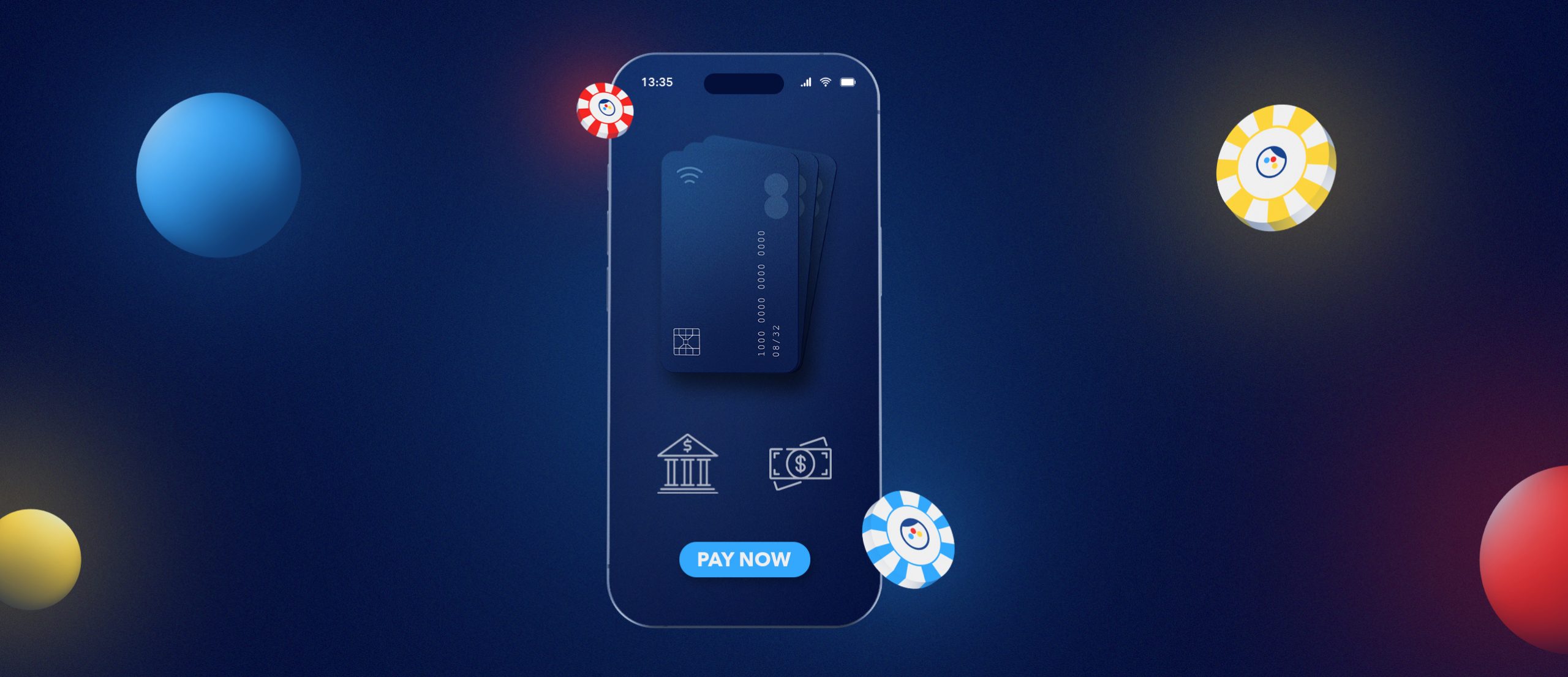

As we journey deeper into the digital age, businesses must evolve to keep up with consumer demands, particularly in terms of payment processing. Payment gateways, an integral component of this process, have been undergoing significant advancements that directly influence how e-commerce, online retailers, and bricks and clicks operate.

The Changing Landscape of Payment Gateways

In the past, payment gateways primarily functioned as a bridge between transactions, authorizing credit card or direct payments processing. Today, payment gateways are becoming more sophisticated, connecting multiple acquiring banks and payment methods under one system.

Payment gateways now provide services that initiate e-commerce, in-app, and point-of-sale payments across an array of payment methods. Importantly, while the gateway plays a critical role in these transactions, it doesn’t directly involve itself in the money flow.

The Impact of Technological Advancements

In the era of digital transactions, payment gateways must be more than just facilitators. They must act as protectors of sensitive data, making use of technologies like SSL (Secure Socket Layer) encryption to secure information sent between the customer’s browser and the merchant’s web server.

More advanced payment gateways now allow transaction data to be sent directly from the customer’s browser to the gateway, bypassing the merchant’s systems entirely. This approach reduces the merchant’s Payment Card Industry Data Security Standard (PCI DSS) compliance obligations without redirecting the customer away from the website.

The Future of Payment Gateways

With advancements in technology, payment gateways have evolved to meet the demands of modern e-commerce. They now come equipped with automatic fraud screening tools that scrutinize orders in real time before the authorization request is sent to the processor. These tools include geolocation, velocity pattern analysis, OFAC list lookups, ‘deny-list’ lookups, delivery address verification, computer fingerprinting technology, identity morphing detection, and basic AVS checks.

Further, some payment gateways now offer white label services. These allow payment service providers, e-commerce platforms, ISOs, resellers, or acquiring banks to fully brand the payment gateway’s technology as their own. This white-labelling option allows third parties to maintain an end-to-end user experience without incurring the additional risk management and compliance responsibility of in-house payments operations.

Payment gateways continue to evolve at a rapid pace, meeting the increasing demands for security, efficiency, and ease of use in the digital age. As we look to the future, these advancements will likely become even more integrated into our daily transactions, shaping the way we do business and interact with the online marketplace.