From Cash to Digital: How Asia’s Payment Landscape is Evolving

While the largest gaming show in Asia, SiGMA, is taking place in Manila, the Philippines, the spotlight is not only on the event itself but also on the transformative trends reshaping the region’s finances. One of the most significant shifts is the rise of digital wallets as the preferred payment method across Asia. As digital technology advances, traditional payment methods such as cash and physical credit cards are increasingly overshadowed by digital wallets’ convenience, security, and efficiency.

This change is revolutionising physical retail environments, e-commerce, and iGaming, highlighting a broader trend towards cashless societies. In this blog, we will explore the surge of digital wallets in key Asian markets, their future growth prospects, and the evolving payment preferences across the region. Read on to learn the role of credit cards and Buy Now Pay Later (BNPL) services and the implications for businesses and consumers.

The Rise of Digital Wallets in E-commerce

Digital wallets are the dominant payment method in several major Asian markets, with China leading at 82% usage, followed by India at 56%, Indonesia at 40%, the Philippines at 34%, and Vietnam at 36%. These countries have experienced rapid growth in digital wallet adoption, fueled by mobile payment platforms like Alipay, WeChat Pay, Paytm, and GCash.

The trend is set to continue, with digital wallets projected to become the leading e-commerce payment method in Hong Kong, Singapore, South Korea, and Taiwan by 2027. This forecast underscores the increasing trust and reliance on digital payment solutions across the region.

Digital Wallets at the Point of Sale

The dominance of digital wallets extends beyond e-commerce, penetrating the physical retail environment. In 2023, digital wallets surpassed 50% of point-of-sale (POS) spending in Asia, representing over $7.8 trillion. China and India are leading this transformation, with digital wallets forecasted to become the primary payment method in all Asian markets by 2027. The growth of digital wallets at POS is expected to continue at a 13% CAGR, reaching 66% of Asian POS spend (~$12.7 trillion) by 2027, according to World Pay.

Credit Cards and BNPL Services in Asia

While digital wallets dominate, credit cards still hold a significant share in some Asian markets. In 2023, credit cards were the top online payment method in Hong Kong, Japan, Singapore, South Korea, and Taiwan. For instance, 57% of online transactions in Japan were made using credit cards, indicating a strong preference for traditional payment methods in certain regions.

Buy Now Pay Later (BNPL) services have also seen substantial demand, capturing 4% of the regional online spending and generating over $120 billion in transaction value. With a projected compound annual growth rate (CAGR) of 16% through 2027, BNPL is set to become an increasingly popular payment option, offering consumers flexibility and convenience.

Decline of Cash and Physical Cards

Cash usage rapidly declines across Asia, dropping from 19% to 16% of regional POS transaction value in 2023. We foresee this progression extending further, reflecting the shift towards cashless societies. Despite the rise of digital payments, physical credit cards remain preferred in Hong Kong, Singapore, South Korea, and Taiwan, while physical debit cards are more popular in markets like Australia.

The rapid adoption of digital wallets in Asia signifies a major shift in consumer payment preferences. As digital wallets evolve, offering enhanced security and convenience, their dominance in e-commerce and POS transactions will grow. The decline of cash and the emergence of alternative payment methods like BNPL further highlights the adaptable nature of the region’s payment framework.

Breakdown of Payment Preferences Across Asia

Asia’s vast and varied economy results in differing payment preferences across countries:

- China: 82% digital wallets

- Hong Kong: 41% credit cards

- India: 56% digital wallets

- Indonesia: 40% digital wallets

- Japan: 57% credit cards

- Malaysia: 39% Account to Account (A2A)

- Philippines: 34% digital wallets

- Singapore: 42% credit cards

- South Korea: 56% credit cards

- Taiwan: 47% credit cards

- Thailand: 44% A2A

- Vietnam: 36% digital wallets

Popular Payment methods

- China: Digital wallets are the best choice for both online (e-commerce) and point-of-sale (POS) transactions, with credit cards as the next option.

- Hong Kong: Credit cards are the most commonly used payment method for online purchases and point-of-sale transactions. Digital wallets are the second most popular choice.

- India: Digital wallets and credit cards are the most common payment methods for e-commerce, while cash and digital wallets are the most used for point-of-sale transactions.

- Indonesia: For e-commerce, digital wallets are favoured, while cash is preferred for point-of-sale purchases.

- Japan: Credit cards are the preferred method for e-commerce, with cash being commonly used at point-of-sale locations.

- Malaysia: A2A transfers are the top choice for e-commerce payments, and cash is primarily used at POS.

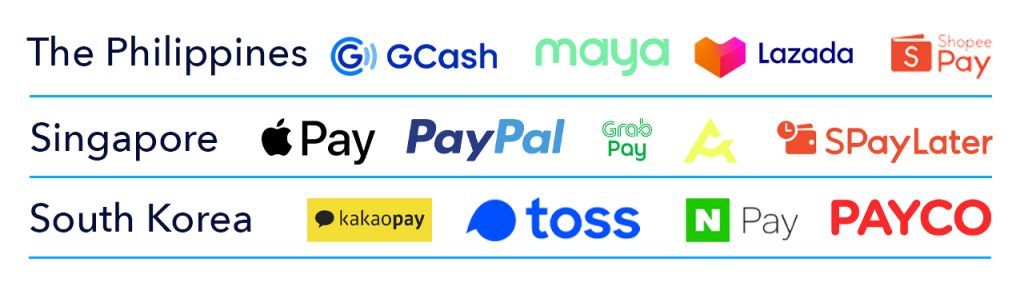

- The Philippines: Digital wallets are used for both e-commerce and POS transactions, whereas credit cards are primarily used for e-commerce.

- Singapore: Credit cards and digital wallets are the preferred payment methods for both online and in-store transactions.

- South Korea: Credit cards and digital wallets are commonly used for e-commerce and point-of-sale transactions.

- Taiwan: Preferred e-commerce payment methods include credit cards, digital wallets, and A2A transfers. Credit cards, cash, and digital wallets are commonly used for point-of-sale transactions.

- Thailand: Popular e-commerce payment methods include A2A transfers and digital wallets, while cash and digital wallets are commonly used at point-of-sale locations.

- Vietnam: E-commerce payments are mainly made via digital wallets and A2A transfers, while cash and digital wallets are commonly used at the point of sale.

Bottom Line

The rise of digital payment methods in Asia represents a significant transformation in the region’s financial industry, providing various advantages such as improved security and convenience. Therefore, this shift requires both businesses and consumers to adapt to the cashless trend, facilitating a more efficient and refined financial and gaming experience.

Moreover, it is imperative to partner with trustworthy payment service providers like GumBallPay to benefit from innovative technology, global coverage, high transaction approval rates, local acquiring banks and alternative payment methods.

Embrace the future of payments with GumBallPay, the stable and innovative payment provider. Reach out to learn more about card processing, open banking and APM’s for your online casino and iGaming platform.